Banking & Finance

Quickly identify and reduce the impact of financial crime.

Empowering your business to quickly identify and reduce the costs of financial crime.

Organised Crime & Terrorism Financing

Application Fraud

Giving false information to gain unauthorized benefits or services.

Bribery and Corruption

Offering, giving, or receiving something of value to influence actions or decisions.

Identity and Online Fraud

Use of an individual's personal information for financial gain.

Anti-Money Laundering Investigations

Uncovering activities that disguise the origins of illegally obtained funds.

Supply Chain Integrity

Ensuring the security and reliability of goods and services to guard against disruptions and risks.

-

Protecting your business against ever increasingly sophisticated fraud actors is a constantly evolving challenge.

Identifying risks and conducting subsequent investigations are often difficult due to data segmentation across the organisation’s business units.

-

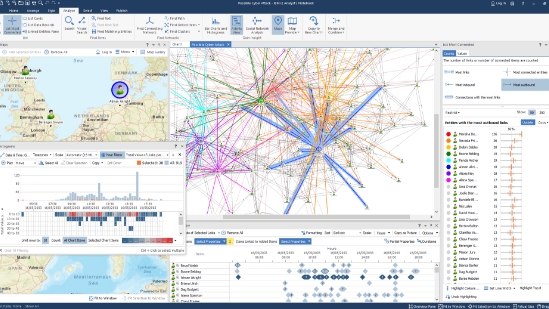

i2 is a proven counter-fraud solution used by many organisations within the Financial Services Sector.

Taking an all-source holistic approach across both internal, partner, and open-source data, i2 can help quickly identify, enrich, and attribute information; unlocking insights for more efficient investigations.