With thousands of mobile insurance claims to process, CPP Group used i2 to not only detect but prevent fraudulent insurance claims from being made and secured a 50% increase in fraud detection.

CPP Group plc (CPP) is a provider of card, identity protection and mobile phone insurance, and has the daunting task of processing thousands of mobile insurance claims.

In the midst of an economic downturn, it became even more critical for CPP to be able to discern between legitimate and fraudulent claims. In January 2009, CPP created a Fraud Investigation Unit (FIU) with eight analysts to find, stop and prevent fraud.

Despite the establishment of the new unit, CPP continued to face difficulties in analyzing their fraud intelligence data. While their fraud identification rates increased by the hundreds, their insurance claim administrative system limited their detection rates. Their internal claims system required analysts to pore over data tables containing over a million customer records, while lacking any ability to visualize their data.

The FIU needed tools that could efficiently gather and store large volumes of data that allowed easy cross-referencing of data points to simplify the process of identifying fraudulent claims.

Raphael Lawson, Head of Fraud for the FIU, had previous experience with i2 software. He understood that i2 Analyst's Notebook and iBase could be utilized to not only detect and

stop fraudulent claims, but streamline productivity and expand their analysis capabilities.

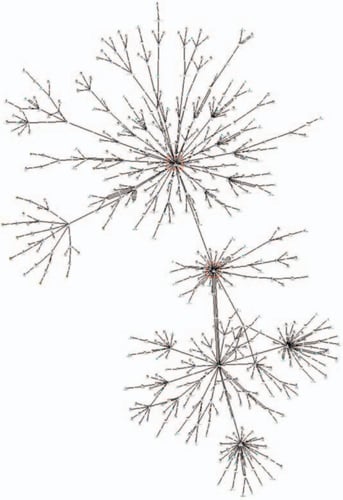

During the pilot phase of iBase and i2 Analyst's Notebook, Lawson's FIU immediately noticed a drastic upsurge in their ability to identify fraudulent claims. By importing their vast quantity of customer records into iBase, the FIU was instantly able to connect 5,000 previous fraud alerts to well over 100,000 customers through i2 Analyst's Notebook. They were able to visualize both organized networks of fraud as well as individual customers. iBase recognized repeat claim

submissions from known fraudsters and blacklisted individuals who were changing minor details such as surnames, bank accounts, mobile phone numbers or addresses to avoid detection, which allowed CPP to save money by stopping these policies before further claims could be made.

Together, i2 Analyst's Notebook and iBase provided a cross-referenceable database and the ability to visualize previously unknown fraudulent connections.

Upon utilizing i2 products, we revealed far more useful intelligence that allowed us to not only detect more fraud, but more importantly, we were able to stop it.

Raphael Lawson, Head of Fraud,

Fraud Investigation Unit at CPP

Over the initial three-month period of deployment, CPP identified over 1,500 individuals connected to false claims and led to the FIU obtaining licenses for iBase and i2 Analyst's

Notebook. Upon purchase, Lawson's team underwent training in both iBase Designer and i2 Analyst's Notebook and the products were fully implemented into FIU on a customized SQL server.

While the FIU's capabilities had grown during their trial usage, following training the team was able to double their ability to identify fraud.

Exposing the full criminal network of known fraudsters within CPP's data would

have been previously undetectable without i2's Analyst's Notebook and iBase.

The implementation of iBase and i2 Analyst's Notebook allowed the FIU to not only detect, but stop fraud.

Within five months of utilizing i2 software, the FIU has seen an approximate 50%

increase in fraud detection, equating to roughly £150,000 in savings for both CPP and its customers. Lawson, however, thinks they can do even better, and is in the process of

acquiring additional licenses for iBase and i2 Analyst's Notebook for his Counter Fraud Specialists.

One of my main concerns when purchasing an intelligence system was cost and after sales support, both of which have been outstanding with i2.

Raphael Lawson, Head of Fraud,

Fraud Investigation Unit at CPP

The FIU's nearly instant success in stopping mobile insurance fraud with i2 products, has led to further integration within CPP. Lawson says, "Once the initial installation and design is complete, the user-friendly interface makes light work of identifying networks in our own data," thus making it a valuable tool to deploy for credit card fraud detection.

Find out more about i2 Analyst's Notebook, iBase or contact us to see how we can help you with your fraud investigations.

© 2026 i2 Group / N. Harris Computer Corporation. All trademarks owned by N. Harris Computer Corporation.

1 Cambridge Square, Milton Avenue, Cambridge, CB4 0AE, UK